st louis county sales tax rate 2020

2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax Rates for City of St Louis 7144 KB. Louis County Missouri Tax Rates 2020.

Collector Of Revenue St Louis County Website

Subtract these values if any from the sale.

. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. Online auctions continue March 23 2022 through April 20 2022 at 1100 am.

The December 2020 total local sales tax rate was 7613. The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. State Muni Services.

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. Heres how St Louis Countys maximum. The Minnesota state sales tax rate is currently 688.

Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. The income tax rates for the 2021 tax year which you file in 2022 range from 0 to 54. The St Louis County Sales Tax is 2263.

072020 - 092020 - PDF. This page will be updated monthly as new sales tax rates are released. The current total local sales tax rate in Saint Louis County MO is 7738.

The sales tax jurisdiction name is St. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. The St Louis County sales tax rate is 0.

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. Louis which may refer to. CST auctions may extend if a bid is placed within 5 minutes of closing.

The Missouri state sales tax rate is currently 423. The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015.

What is the sales tax rate in saint louis missouri. Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. This is the total of state and county sales tax rates.

What is the sales tax rate in St Louis County. There is no applicable county tax. What Is The Missouri Sales Tax Rate For 2020.

You pay tax on the sale price of the unit less any trade-in or rebate. 102020 - 122020 - PDF. Ad Lookup Sales Tax Rates For Free.

Saint Louis County MO Sales Tax Rate. This is the total of state and county sales tax rates. Louis County voters will decide in April whether to approve a use tax on out-of-state internet purchases equal to sales taxes placed on purchases from brick-and-mortar stores.

St louis county sales tax 2020. The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021. CLAYTON St.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Where can I find information about the laws of the City. Louis Sales Tax is collected by the merchant on all qualifying sales made within St.

The December 2020 total local sales tax rate was also 9679. The Missouri state sales tax rate is currently 423. Continuous Online Land Sale Auction.

Louis County Tax Forfeited Land Sale Auctions. The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

Heres how St Louis Countys maximum sales tax rate of 11988 compares to other counties. Saint louis county mo sales tax rate. The december 2020 total local sales tax rate was 7613.

The St Louis County sales tax rate is 226. There is no applicable county tax. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

To make sure the data represents the market as accurately as possible distressed. Report for the fiscal year ending december 31 2019. Louis County does not charge sales tax on tax forfeited land sales.

Louis County Missouri Tax Rates 2020. Statewide salesuse tax rates for the period beginning July 2020. Interactive Tax Map Unlimited Use.

Statewide salesuse tax rates for the period beginning November 2020. Residents of and people who work in Kansas City or St. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

The current total local sales tax rate in saint louis mo is 9679. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. To further accelerate investment and improve the quality of the countys vast.

Louis County Sales Tax is collected by the merchant on all qualifying sales made. Statewide salesuse tax rates for the period beginning November 2020. Louis county missouri tax rates 2020.

What is the sales tax rate in St Louis County. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax. Louis local sales taxesThe local sales tax consists of a 495 city.

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. 052020 - 062020 - PDF. Louis County Missouri Tax Rates 2020.

Statewide salesuse tax rates for the period beginning October 2020. Louis must also pay a 1 earnings tax which will keep their tax bills somewhat higher than average.

Fourth Quarter 2020 Taxable Sales Nextstl

Missouri Sales Tax Small Business Guide Truic

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

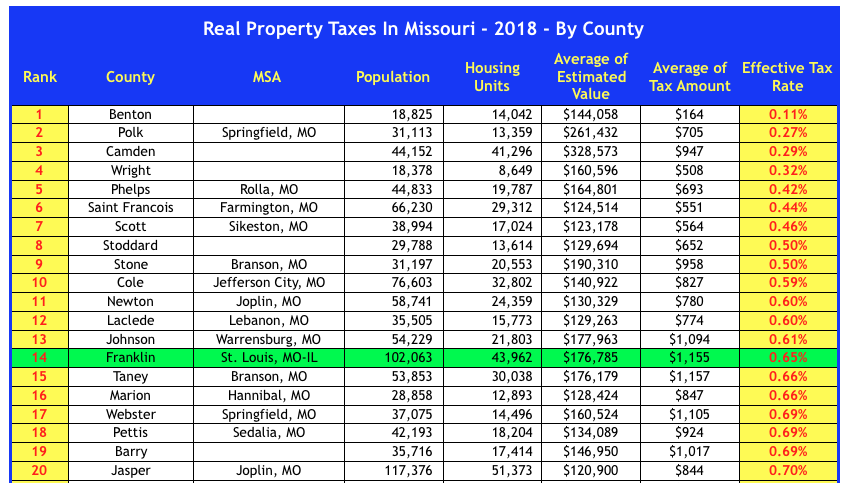

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

City Versus County Tax Sales Your St Louis Missouri Guide

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Missouri Sales Tax Rates By City County 2022

St Louis County Establishes Affordable Housing Trust Fund

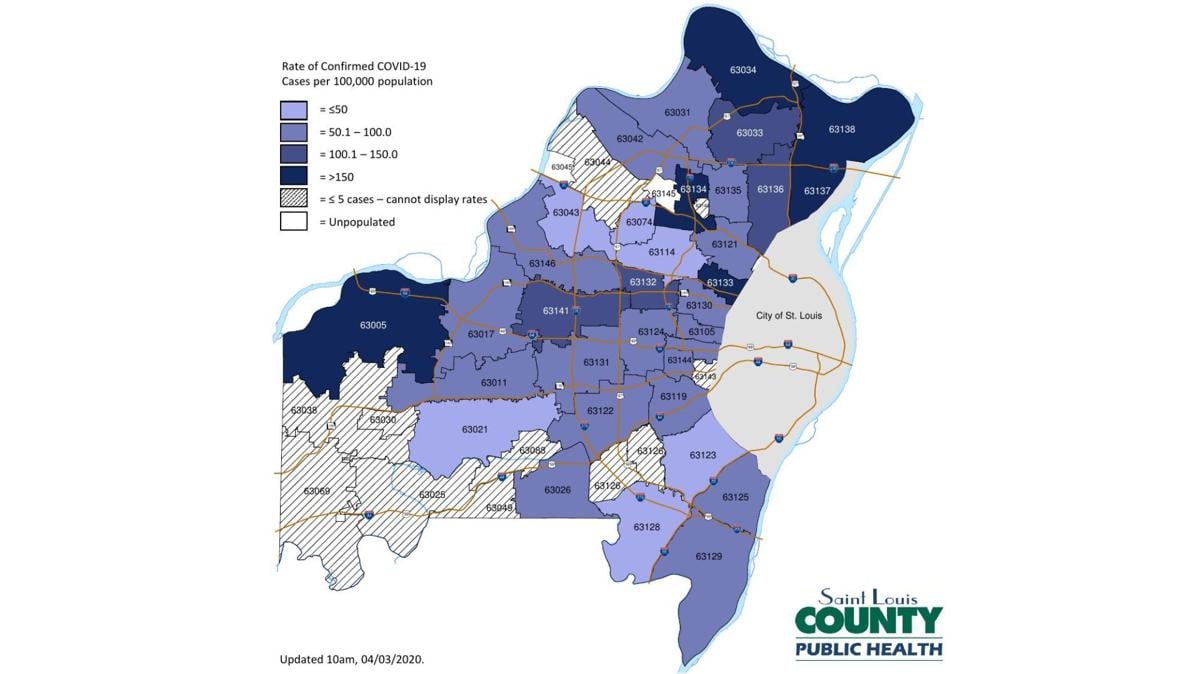

Covid 19 Cases By Zip Code In St Louis County Stlamerican Com

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

St Louis Metro Promotes Transit Investment Plan But Will Need Sales Tax Support To See It Through The Transport Politic

Sales Tax On Grocery Items Taxjar

Fourth Quarter 2020 Taxable Sales Nextstl

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More